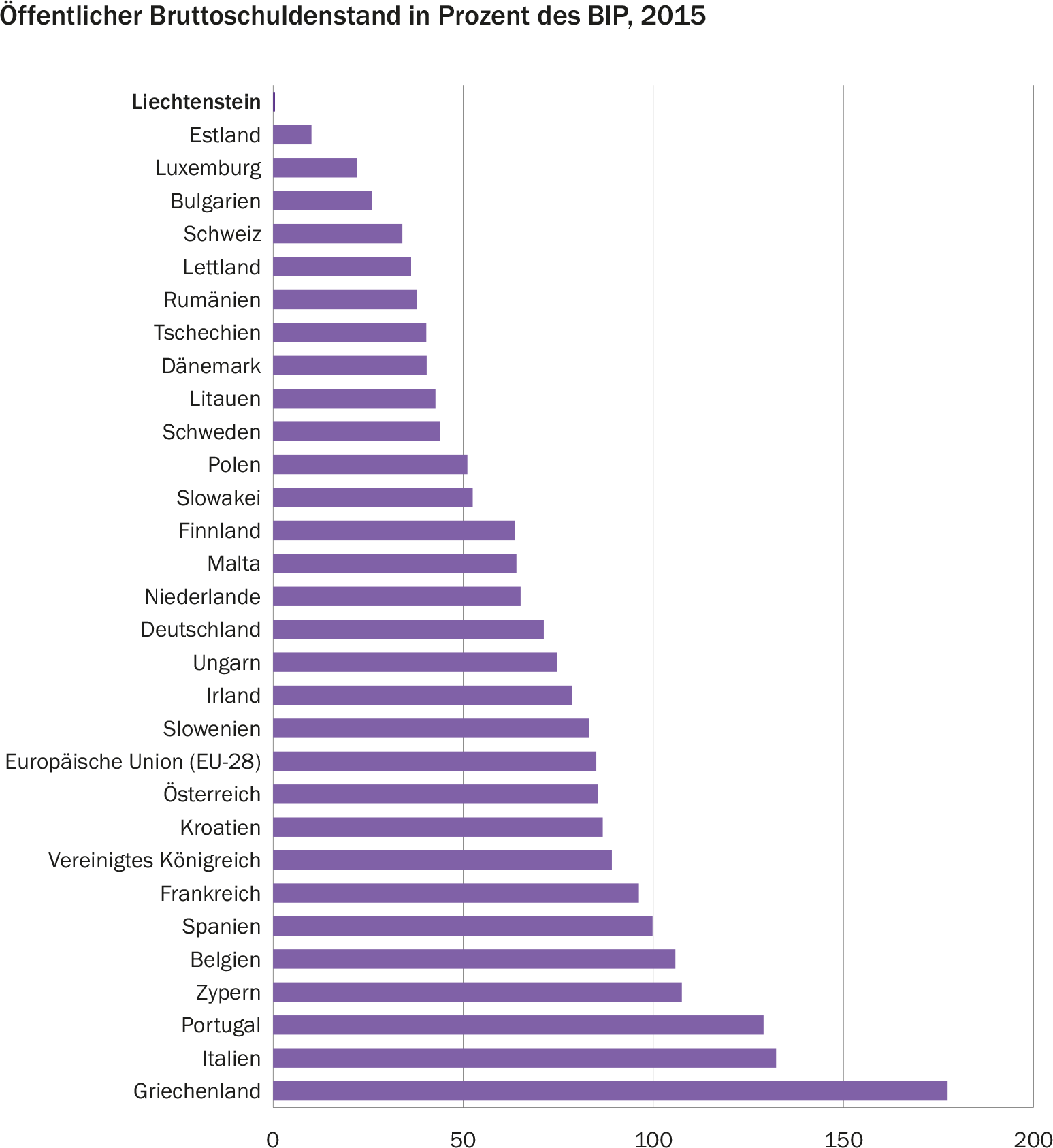

Liechtenstein Portugal Tax : Living In Austria Hilti Headquarters

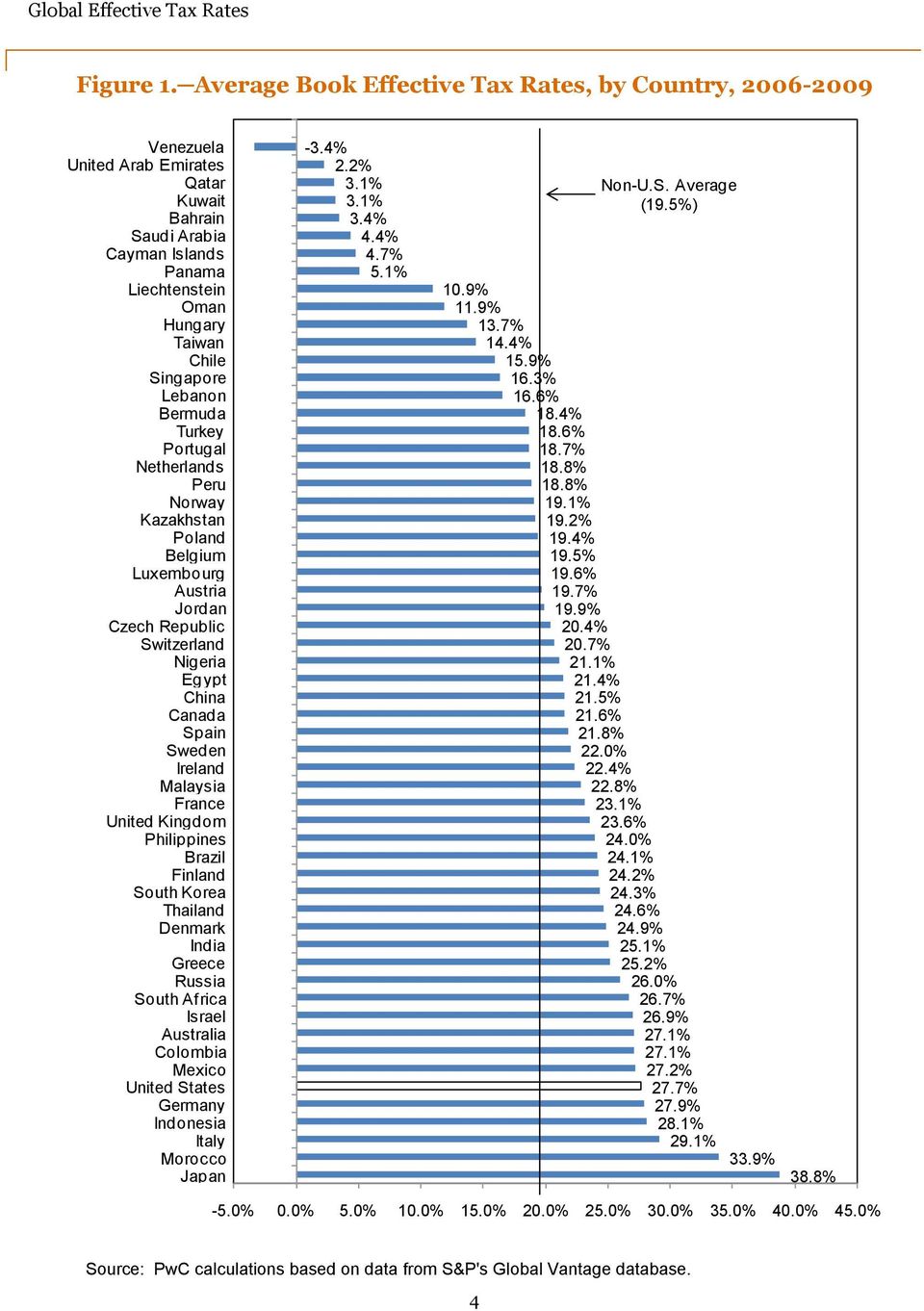

In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. Fiscal laws in the Principality are simple internationally compatible and in line with European legislation.

The Development Of Tax Transparency In Oecd Countries Veroffentlichung Ifo Institut

The agreement also clarifies the tax treatment of asset structures.

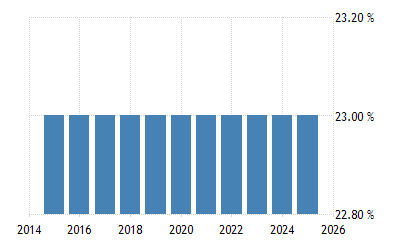

Liechtenstein portugal tax. Each individual municipal sets its own rate which is decided by the municipal assembly. Corporate Tax Rate in Liechtenstein remained unchanged at 1250 percent in 2021 from 1250 percent in 2020. This page provides - Liechtenstein Personal Income Tax Rate - actual values historical data forecast chart statistics economic.

It has a customs union and a monetary. The Personal Income Tax Rate in Liechtenstein stands at 2240 percent. PRINCIPALITY OF LIECHTENSTEIN List of all Double Taxation Agreements DTA as of 22 June 2021 No.

The treaty largely follows the OECD Model Convention and provides for cooperation on tax matters between the tax authorities. The Tax Free Threshold Is 0 USD. Individuals who are employees or are self-employed are subject to capital tax and income tax with a progressive tax system used.

Andorra na 30092015 21112016 01012017 2. Liechtenstein is a constitutional monarchy has a land area of about 160 sq km 60 sq m a population of 37009 July 2013 est and is sandwiched between Switzerland and Austria. Communal tax is a surcharge on the national income tax due.

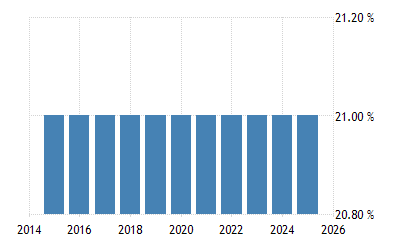

The Liechtenstein tax authority is called the. The main taxes for individuals are income tax which is divided into national tax and communal tax and property profit tax. This page provides - Liechtenstein Corporate Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

Capital gains taxes. Taxes in Portugal are levied by both the national and regional governments of Portugal. The surcharges are fixed annually by the local governments.

In taxes will be required to be paid to the destination countries government. This tax can be fully credited to the profit tax. At least 0162 and at most 08505 for asset tax.

The rates of this tax will vary according to the type of services or goods delivered and some services are even fully tax exempt. A non-resident company generally pays taxes. IMI varies from around 03 to 045 of the value of a home in urban areas.

Property tax IMI As a property owner in Portugal you must pay IMI the Portuguese version of council tax. If your only source of income is from employment in Liechtenstein your income will be taxed at source and you wont have to file a tax return. Citizens in Liechtenstein also have to pay taxes.

Liechtenstein and United Arab Emirates have initialed a tax treaty Liechtensteins Ministry for General Government Affairs announced March 4. Switzerland carbon tax Liechtenstein carbon tax 58 Finland carbon tax other fossil fuels 28 Ireland carbon tax transport fuels BC carbon tax 21 Alberta TIER Canada federal fuel charge Prince Edward Island carbon tax South Africa carbon tax 7 Beijing pilot ETS 12 5 Chongqing pilot ETS RGGI Shanghai pilot ETS Chile carbon tax 3. Consequently the tax rate consists of the national tax rate combined with the surcharges which results in tax rates from 25 to 224.

Assuming a municipal tax surcharge of 200 the minimum and maximum tax rates are as follows. Austria na 05111969 07121970 01011969 3. They have owned it for 10 years.

Taxation in Portugal. In addition VAT applies to most goods and services. The import tax charged on a shipment will be.

For example if the declared value of your items is. Basis of Taxation Resident companies are taxed on worldwide income. In rural areas it can be as much as 08.

Otherwise tax returns are due by April 15th. The general VAT rate in Liechtenstein is 77 percent and was reduced from 8. In order for the recipient to receive a package an additional amount of.

Under a lone exception minimum tax is not due if the total assets of an operating entity did not exceed CHF 500000 during the last three years. Jurisdiction MLI Date signed Entry into force Effective date 1. Personal Income Tax Rate in Liechtenstein averaged 2080 percent from 2007 until 2020 reaching an all time high of 24 percent in 2015 and a record low of 1701 percent in 2008.

The average cost of living in Liechtenstein 2245 is 132 more expensive than in Portugal 967. On the full value of your items. Capital gains are taxed in Liechtenstein.

In 2004 along with Switzerland Liechtenstein accepted the EUs Savings Tax Directive and imposed a withholding tax on interest and other savings returns paid to citizens of the member states of. It is their only source of capital gains in. Residence A company is resident in Liechtenstein if it is incorporated in Liechtenstein or if the place of effective management is situated in Liechtenstein.

Therefore Liechtenstein has reformed their tax systems to fully comply with EU tax good governance principles and has now been removed from the EU grey list of tax havens a good sign for the Blockchain community. Communities levy a surcharge of between 150 and 250. Financial Year 1 January 31 December Currency Swiss Francs CHF.

Tax revenue in Portugal stood at 349 of GDP in 2018. The most important revenue sources include the income tax social security contributions corporate tax and the value added tax which are all applied at the national level. Although Liechtenstein is not part of the European Union good relationships to the EU are key to the nations economic success.

The average after-tax salary is enough to cover living expenses for 27 months in Liechtenstein compared to 1 months in Portugal. The property is directly and jointly owned by husband and wife. Liechtenstein ranked 4th vs 65th for Portugal in the list of the most expensive countries in the world.

The Liechtenstein tax year is the same as the American tax year which is to say the calendar year. The list below includes the main VAT rates in Liechtenstein-general rate. At least 324 and at most 1701 for income tax.

The full tax amount is due even if the corporation is not resident in Liechtenstein for the whole tax period.

Living In Austria Hilti Headquarters

Compulsory Tax Audit For Liechtenstein Banks Accounts Portugal Resident

Portuguese Taxes For 2020 Blevins Franks Advisers

Taxes In Liechtenstein Hilti Headquarters

Portugal Sales Tax Rate Vat 2021 Data 2022 Forecast 2000 2020 Historical

Taxes In Liechtenstein Hilti Headquarters

German Portuguese Double Taxation Agreement Scope Of Application And Taxation Law Rodl Partner

Pdf List Of Tax Haven Country Melisa Mouren Kalangi Academia Edu

Liechtenstein Individual Taxes On Personal Income

Portugal Corporate Tax Rate 2021 Data 2022 Forecast 1981 2020 Historical Chart

Global Effective Tax Rates Pdf Free Download

Living In Austria Hilti Headquarters

Liechtenstein Vs Portugal Comparison Cost Of Living 2021

How To File Us Taxes As An American In Portugal Expat Taxes In Portugal

Liechtenstein Vs Portugal Comparison Cost Of Living 2021

2008 Liechtenstein Tax Affair Wikipedia

How To Pay Portuguese Taxes While Abroad Portugal Resident